will the salt tax be repealed

House of Representatives passed the Restoring Tax Fairness for States and Localities Act HR. As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax.

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Americans who rely on the state and local tax SALT deduction at tax time may.

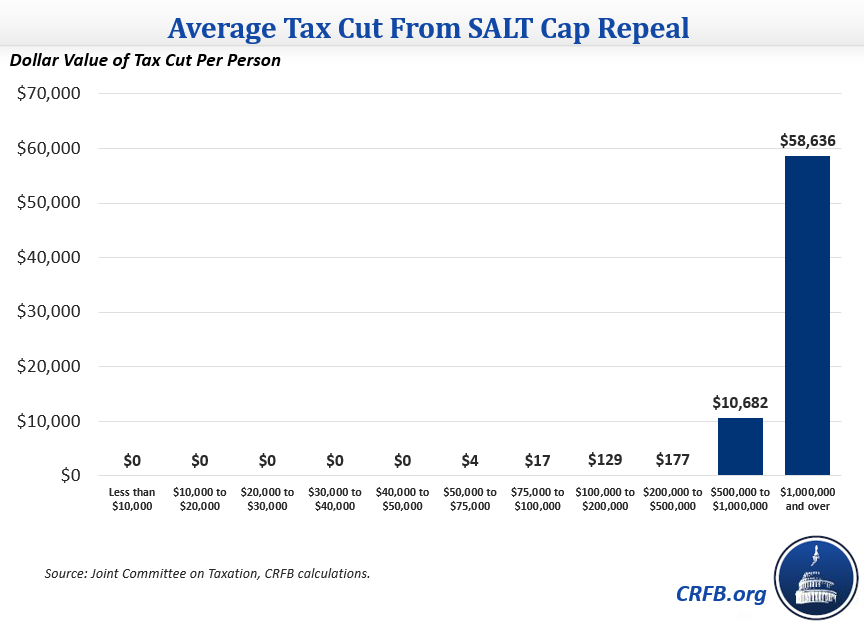

. A two-year SALT cap repeal. New limits for SALT tax write off. Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government.

The lawmakers are urging. The Tax Foundation predicts that a full repeal of the cap. Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only.

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. 5377 which would suspend the 10000 cap. A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging.

The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. Joe Manchin D-WVa raised broader objections to President Bidens social spending and. SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing.

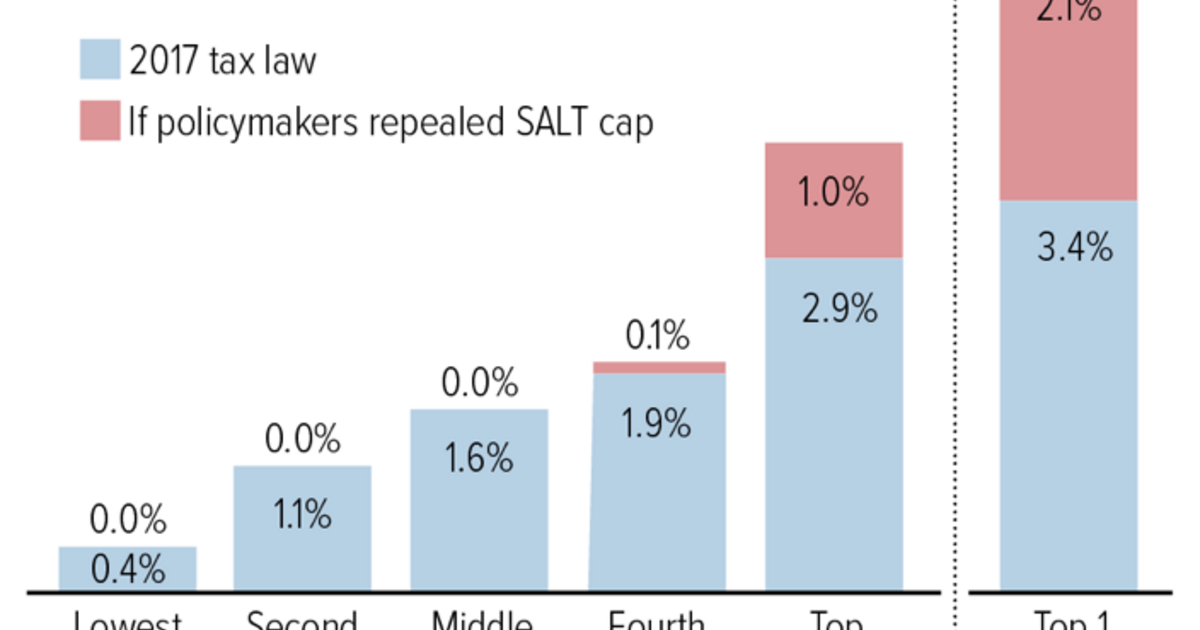

According to press reports the Senate is considering repealing the 10000 cap on the state. All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut.

March 1 2022 600 AM 5 min read. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. A two-year SALT cap repeal.

On December 19 the US. SALT Cap Repeal Below 500k Still Costly and Regressive. If the cap were.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. A new bill seeks to repeal the 10000 cap on state and local tax deductions. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed.

Five House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Democrats have defended the SALT deduction repeal and rejected the Republican criticism noting the GOP tax law also lowered taxes for some of the wealthiest Americans. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut.

To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households. In a nation where 87 percent of people already make too little to itemize their tax returns and are therefore not eligible for any SALT deductions Democrats whole campaign is. People earning 50 million to 300 million per year would probably get a tax cut overall from Bidens economic package if the SALT cap is fully repealed said Jason Furman.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Call It Complex Or Simply Confusing Brazilian Tax System Has A Total Of 90 Taxes Duties Contributions Taxgiri Coding Tax Complicated

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Bernie Sanders Is Facing Down Corporate Democrats On Taxes

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

House Democrats Pass Package With 80 000 Salt Cap Through 2030

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Tax Repealed By House Democrats The Washington Post

Left Wants To Give Wealthy Constituents Bigger Salt Deduction