michigan sales tax exemption for farmers

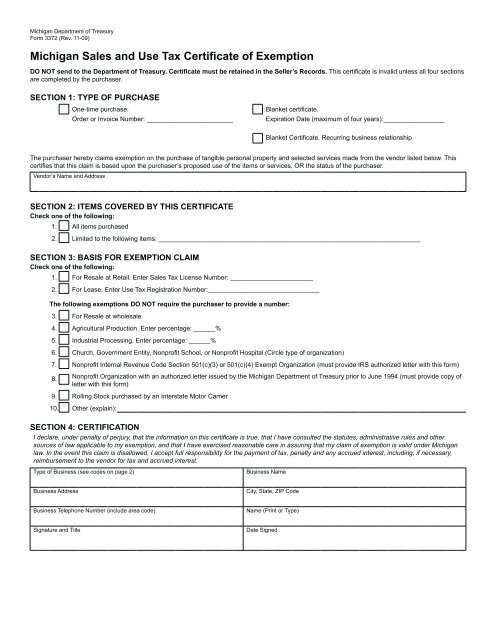

The law says the exemption is for stuff sold to. Michigan Department of Treasury 3372 Rev.

Illinois Sales Tax Exemptions On Farm Equipment

The form must be forwarded to Taxpayer.

. When purchasing sales tax exempt agricultural items in Michigan you must sign a certificate stating that the item is for agricultural production. In order to claim exemption the nonprofit organization must provide the seller with both. Ad Register and Subscribe Now to work on your MI Affidavit for Disabled Veterans Exemption.

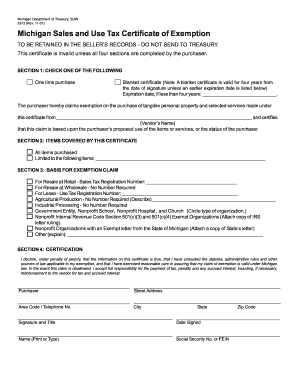

For most agricultural retailers this. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

There is no such thing as a Sales Tax Exemption Number for agriculture. There is no such thing as a Sales Tax Exemption Number for agriculture. Farm Fuel Users Sales and Use Tax Exemption Update Substitute Senate Bill 5009 extends to biodiesel fuel the sales and use tax exemption for farm fuel used for producing agricultural.

A farm is defined by USDA as a place where over. Criteria for Exemptions To be exempt from paying sales tax on a purchase based on the farm-use exemption the item must be. Effective July 24 2015.

Only farm owners qualify for the exemption. Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes. Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put.

You should never use your social security number for retail purchases. Several examples of exemptions to the states sales tax are vehicles which have been sold to a relative of the seller certain types of equipment which is used in the agricultural business or. This exemption claim should be completed by the purchaser provided to the seller.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Send a Michigan Sales Tax Certificate to Wisconsin Public Service Customer Service PO. Farmers Certificate for Wholesale Purchases and Sales Tax Exemptions Farm machinery implements Parts for farm machinery and implements Labor and services for repairing farm.

Streamlined Sales and Use Tax Project Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be. Farms are defined as any place from. With such confusion and a potential 293 million additional tax burden on farm families the law needs clarification Park said.

Request to Rescind Qualified Agricultural Property Exemption. Ad Register and Subscribe Now to work on your MI Affidavit for Disabled Veterans Exemption. Farms are defined as any place from.

Mean that the property is exempt from sales or use tax. You should never use your social security number for retail purchases. In order to qualify for the sales tax exemption a farmer must first apply with the Department of Revenue Service DRS by filing Form REG 8.

01-21 Michigan Sales and Use Tax Certificate of Exemption. The retail sales tax exemption is available only when the buyer provides the seller with a completed Farmers Certificate for Wholesale Purchases and Sales Tax. Requirements for the Michigan Agriculture Exemption for Sales Tax Farm Ownership.

They are also exempt from sales tax on the Fixed Charge if they have no use.

Sales Taxes In The United States Wikipedia

Getting Sales Taxes Up To Speed Michigan Farm News

Michigan Sales Tax Guide For Businesses

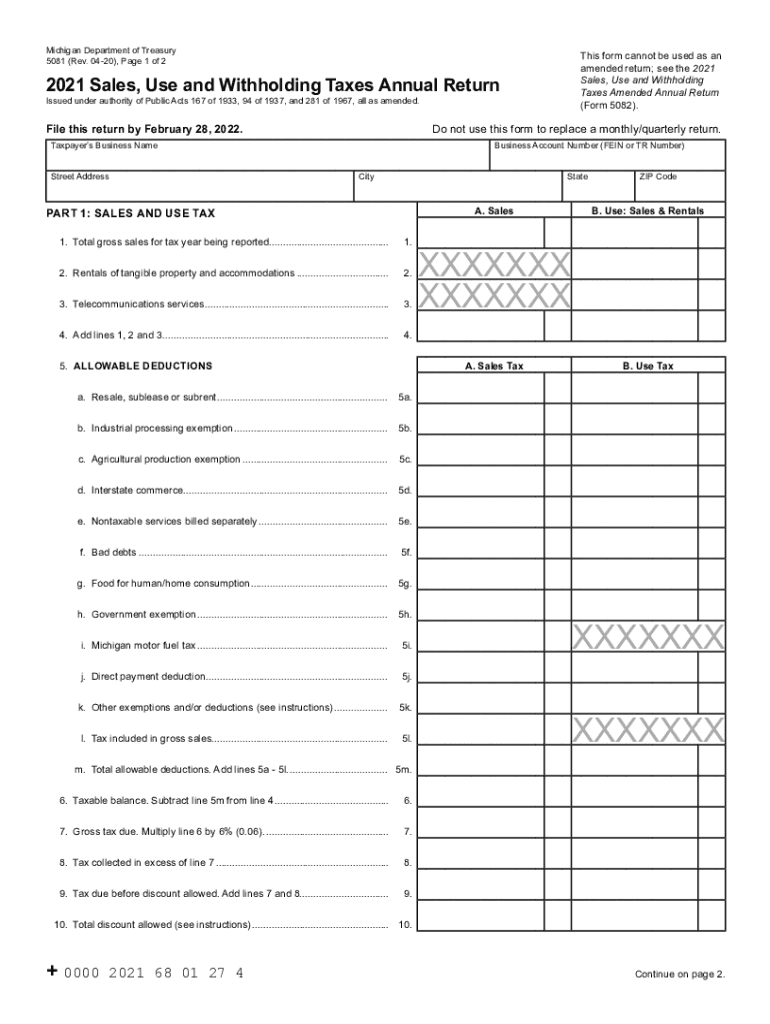

Form 5081 Fill Out Sign Online Dochub

Home Michigan Farm Bureau Family Of Companies

Mi Sales Tax Exemption Form Animart

Sales Taxes In The United States Wikipedia

Michigan Tax Considerations For Alternative Energy Producers Varnum Llp

Michigan Sales Tax Guide For Businesses

2016 Form Mi 5081 Instruction Fill Online Printable Fillable Blank Pdffiller

Sales And Use Tax Regulations Article 3

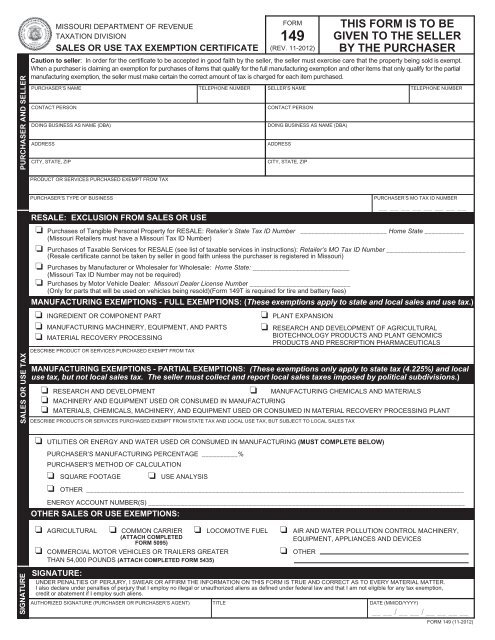

Form 149 Sales And Use Tax Exemption Certificate Missouri

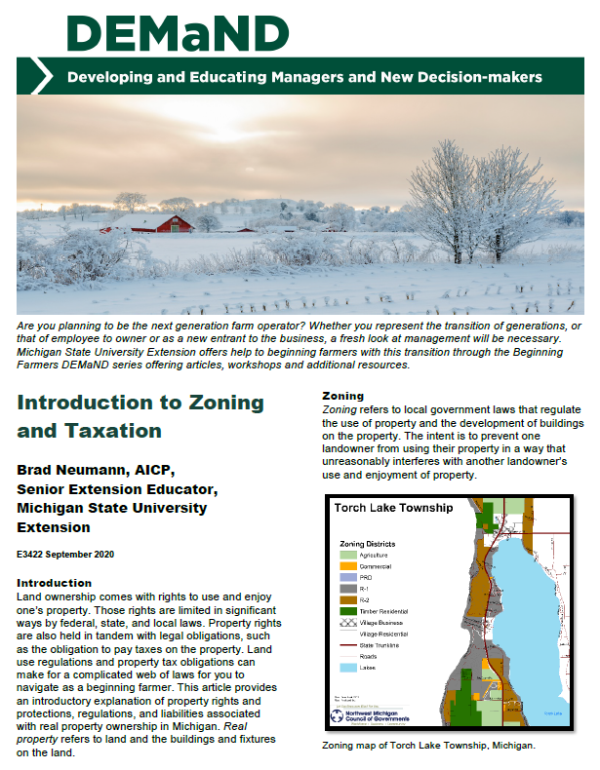

Bulletin E 3422 Introduction To Zoning And Taxation Farm Management

Resale Certificate Michigan Form Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax And Farm Exemption Msu Extension

Bulletin E 3422 Introduction To Zoning And Taxation Farm Management

How To Apply For Minnesota Tax Exemptions For Farmers Sapling

Agricultural Sales Tax Exemptions In Florida Florida Farm Bureau